ABOUT TONY FEDOROV @ FLASHPOINT

Greetings Reader,

I'm a Partner at Flashpoint VC, an early-stage investor focused on Emerging European and Israeli founders in their pursuit to build global software businesses. We aim to be true partners to our founders and assist them with hands on approach from data analysis to building financially prudent business models to insights in scaling sales, marketing and HR.

The articles I write for this blog is yet another tool we hope founders can employ to jump start their companies and overcome scaling endeavors you encounter.

Thank you for reading, and I hope you find some value. If so, I'd highly appreciate it if would you subscribe below or share it within your network.

SUBSCRIBE TO NEWSLETTER

Please fill-in your email address to become a reader of this blog and receive notifications of new posts by email.TO CONTACT ME

anton [at] flashpointvc.com

FOLLOW ME

Anton Fedorov

- Venture Capital

- 3 min read

Power law and implications for portfolio management

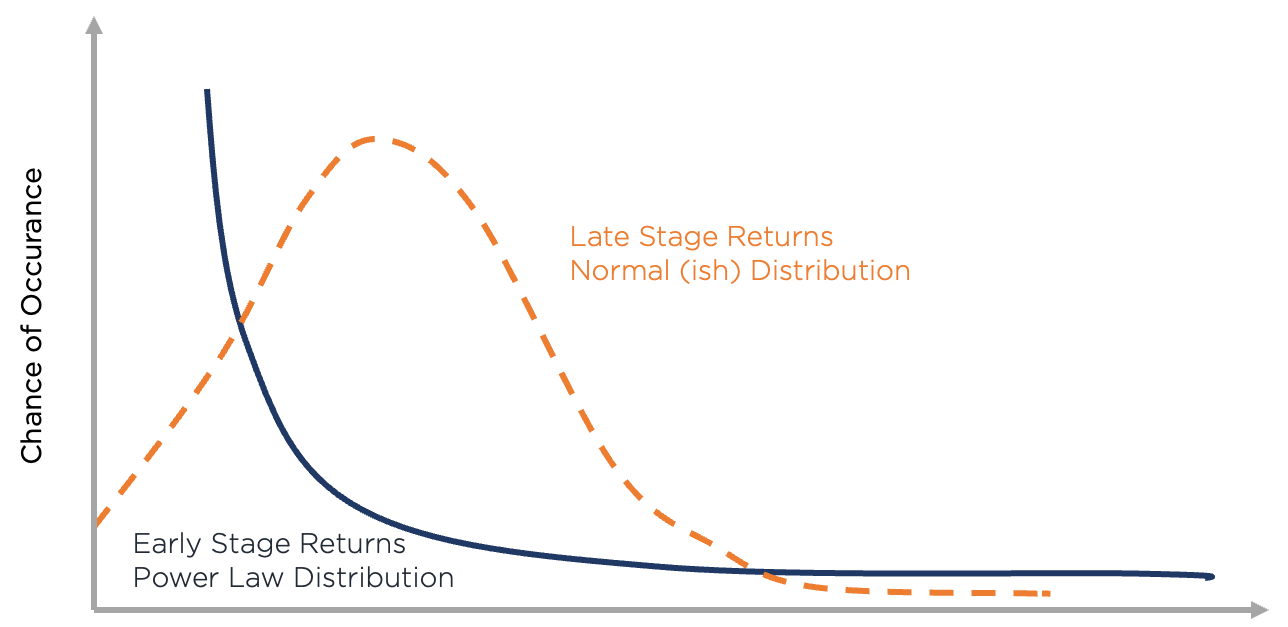

Unlike the stock market, where a Gaussian distribution with fat tails more or less describes the return outcomes, the distribution of returns in the venture world is subject to exponential distribution (The Power Law). Namely, less than 10% of capital drives typically 50%+ of fund returns and more than 90%

a year ago

- 2 min read

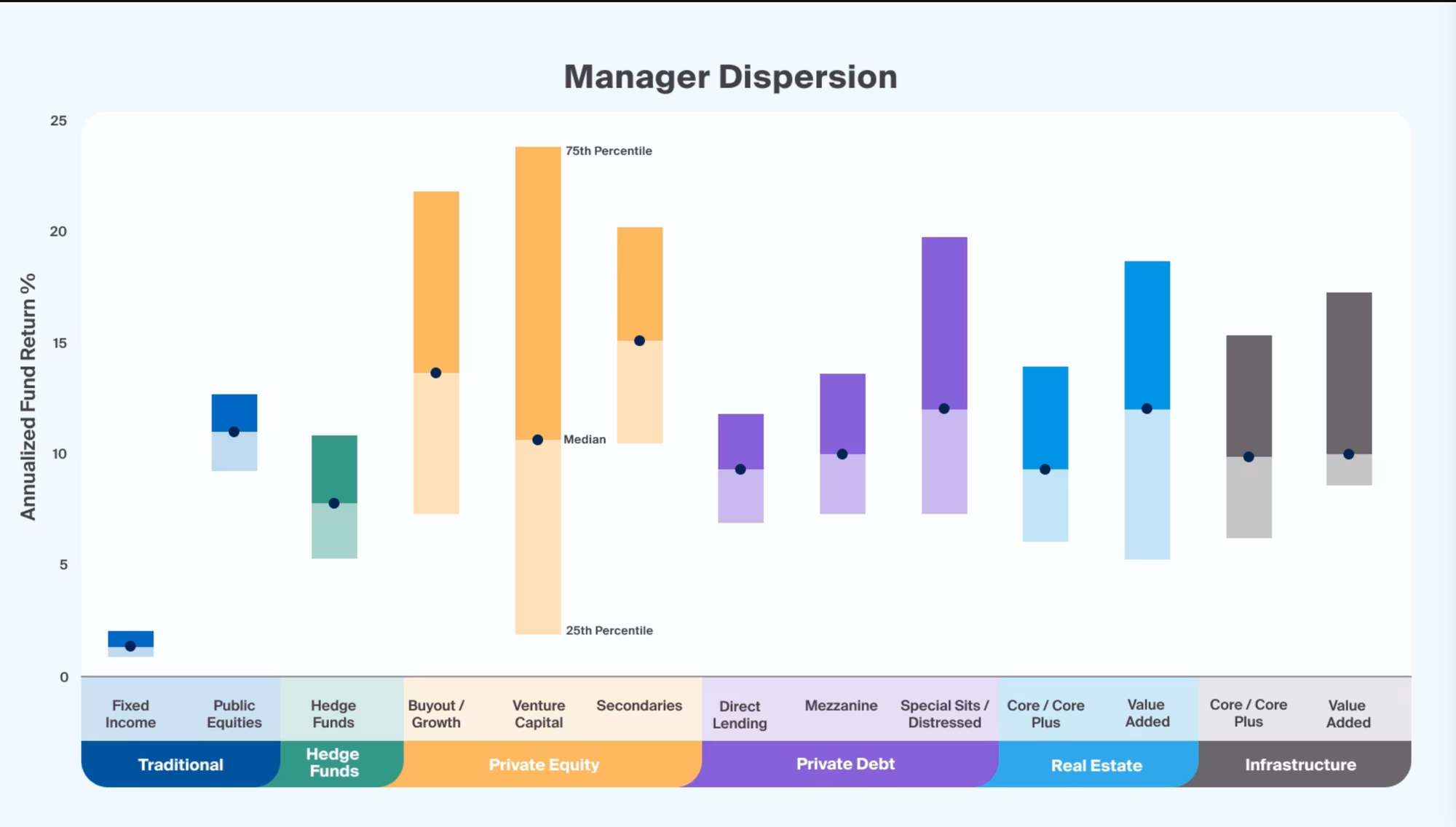

Power Law vs Bell Curve in Investing

In the world of investment, knowing your distribution is hyper-critical. It sounds mathematical, but understanding the dynamics of "Power Law" vs "Bell Curve" is important for investors navigating between the public and private capital markets. Investing in public assets: Bell Curve dominance 🔔 In public markets, investment

2 years ago

- 6 min read

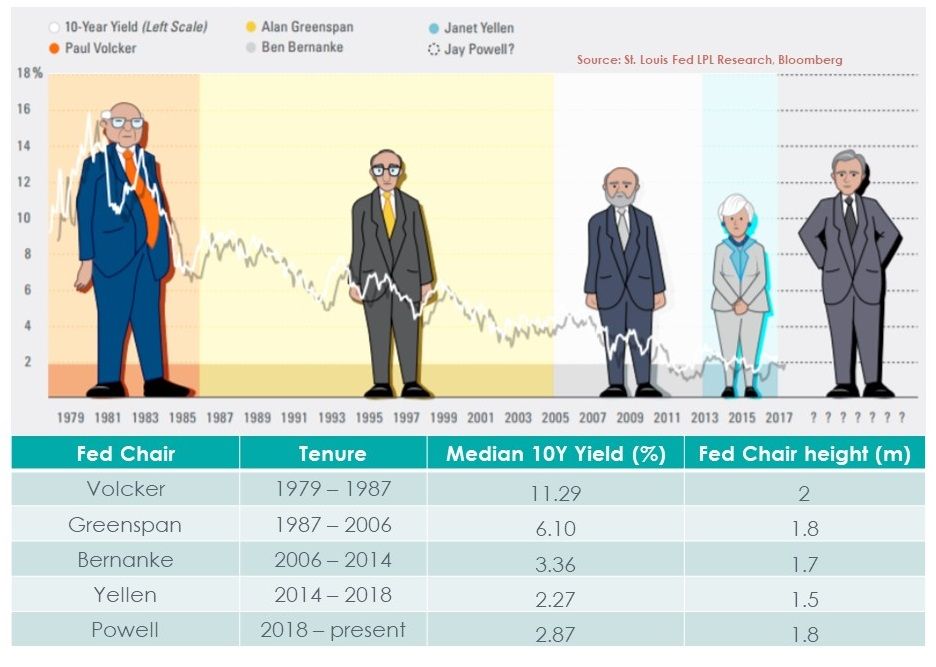

Framework for operating tech businesses in a high-interest rate policy

Technology startups have been on the rise over the last decade and for a good reason: from changing the distribution model of software to the cloud to the rise of machine learning and AI also rhymes with the introduction of new technologies such as blockchain. However, scaling a technology startup

3 years ago

- SaaS metrics

- 15 min read

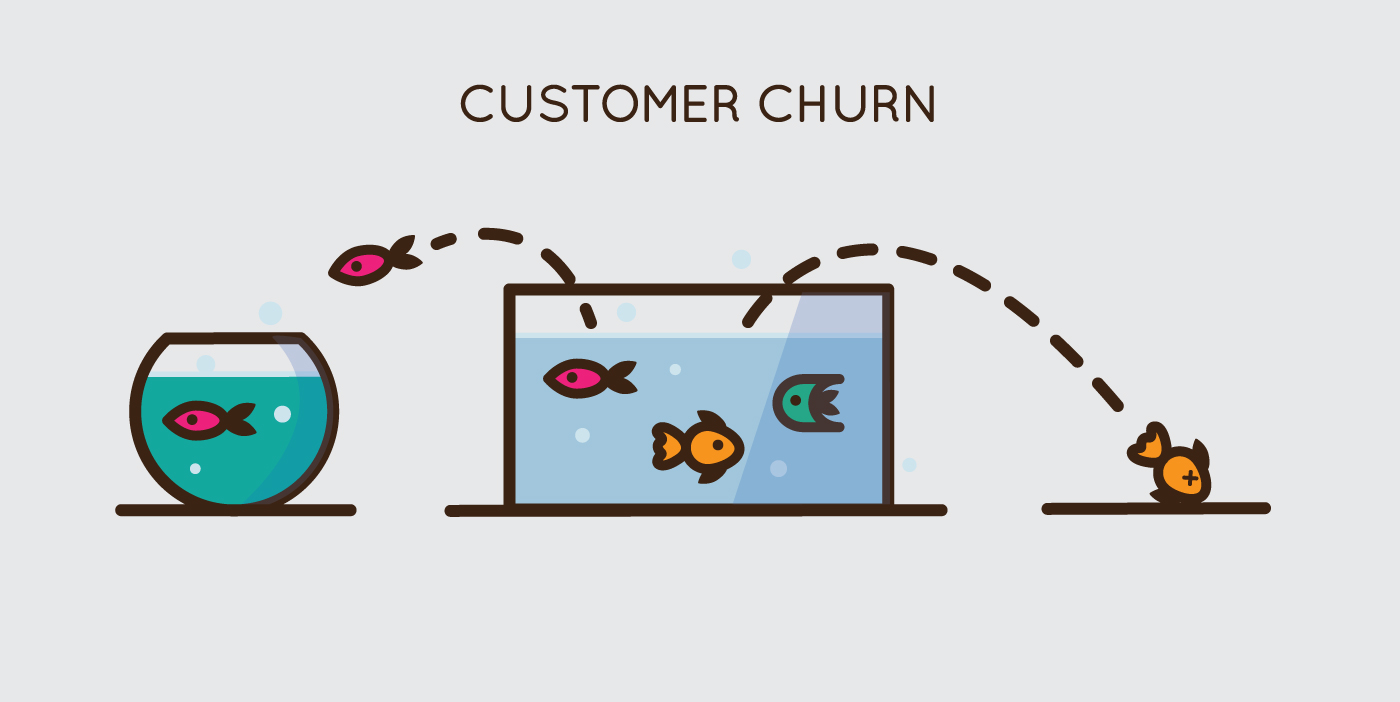

How To Calculate Churn And Churn Rate For SaaS Companies: A Complete Guide

If there's one business metric that rules them all - it's churn. No wonder, many executives and VCs call it "The Silent Killer". And despite that most of the time everyone in the tech ecosystem (founders, investors, media, etc) are focused on nailing growth

3 years ago

- 5 min read

Startup founder mistakes from 0 to 1

Zero to One (or 0 to 1) - is going from nothing to something, for SaaS companies this usually means going from pre-revenue to $1m in annual recurring revenue. Given the zero base - it's the biggest leap that a company will have to achieve on its path

3 years ago

- Scaling

- 7 min read

SaaS Magic Number: measuring scaling efficiency

Tons of metrics can be calculated for any SaaS business. In order to determine how your start-up is performing in a business environment, it's essential to calculate the SaaS Magic Number and various other sales efficiency metrics. Although the metric is overlooked in the SaaS startup community, it’

6 years ago