How To Calculate Churn And Churn Rate For SaaS Companies: A Complete Guide

If there's one business metric that rules them all - it's churn. No wonder, many executives and VCs call it "The Silent Killer". And despite that most of the time everyone in the tech ecosystem (founders, investors, media, etc) are focused on nailing growth target - without understanding the core dynamics of customers' churn rate it's impossible to scale effectively.

In this guide, we will talk about the churn rate, why its factors, how to calculate it, and much more. It helps you to distinguish the different business terms that are used to measure the churn rate and as a result growth of a SaaS company.

Table of Content:

- Prelude

- Definition: what is the churn rate?

- Why does churn matter?

- What causes customers to churn?

- How do you measure and calculate the churn rate?

- Churn Rate Formula

- Monthly vs. Annual Churn Rates

- Gross churn / Customer Churn

- Net Churn / Revenue Churn

- MRR Churn

- How to Reduce Churn

- B2B vs B2C Churn

- Customer Churn Analysis

- How to predict churn

- Churn Benchmarks

Prelude

It's no secret that returning customers have a significant impact on the growth of any business, especially for SaaS companies. Usually for the reason that it is much cheaper to retain a customer than to acquire one.

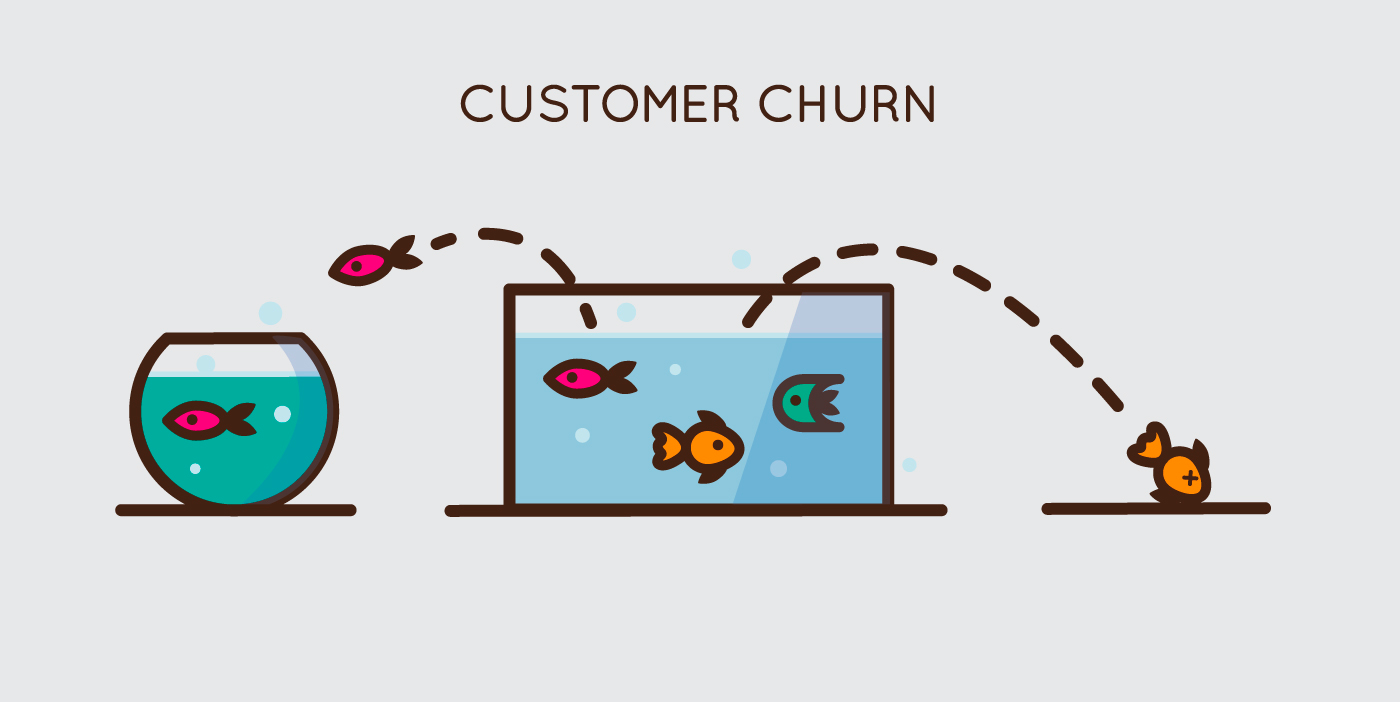

Churn rate in the broadest sense is a measure of the number of users/individuals/customers/items moving out of a collective group over a specific period. Usually, transactional business owners take their growth rate as the growth in the revenue for the specified period. For example, they measure the increase in sales volume and take it as a growth rate.

But for SaaS companies, when calculating growth rate because transactions are recurring, churn rate impact how recurring revenue behaves and affects the overall growth. Churn rate not only helps to find the true level of growth of a SaaS company but is also beneficial to measure the performance of product/customer support/customer success teams.

Churn can occur at any stage during the journey of the customer with the business, so it is important to calculate it at regular intervals.

Also, measuring churn correctly is not only important for product decisions but also when raising capital to scale your SaaS business at any stage. To satisfy the investors' expectations - a company needs to have a healthy churn rate metric.

What Is Churn Rate?

The churn rate refers to the number of clients or customers that stops to avail of the services offered by a SaaS company. To rephrase, it is the percentage of customers that don't renew the services within the specified time. Depending on the type of contract: monthly, quarterly, or annual - it could very much variation in size.

Churned customers are very painful, especially when you have a limited number of customers attached to your SaaS company.

Churn is a silent killer of business and when isn't tackled it in the early stage, it'll erode business from the inside limiting its growth"

Churn rate could either be good or bad, and both provide a clear indication of deficiency areas. For example, if you come up with a churn rate of 10% and 20 clients in total, it means you are losing two clients every month. It is good that you are retaining 90% of your clients.

But you have to work twice as you do in the past. First, you have to work for the growth of your business, and second to replace the leaving customers with the new ones. Otherwise, at some point, the client's graph goes to zero.

For new or small SaaS companies, the churn rate may be higher initially, but it goes down as people start liking your services. If the churned customer finds your services good compared to your competitors, he/she must join your services again.

Why Does Churn Rate Matter?

As mentioned earlier, the churn rate is known as the silent killer of SaaS companies because it drains the struggle that you do for gaining a customer. When a customer doesn't pay for the next tenure, it means all the time and resources gone in vain that you put into convincing the customer.

Furthermore, gaining new customers again requires time and resources that are more expensive than retaining old customers. It means the cost of marketing increases, and the ROI of SaaS companies goes down.

On the other hand, if you get success in retaining the current customer, it means you are participating massively in boosting the profit of the company.

The retention of the current customer is more worthwhile as compared to gaining the new one. Because it shows that the customers trust the services you provide and indicate the level of business sustainability.

What Causes The Customers To Churn?

There could be many reasons that force customers to churn. The following are the most common factors that cause customers to churn.

1. Attracting the Wrong Customers

Attracting customers that don't fit your core value proposition is the primary reason for the high churn rate. Usually, new SaaS companies start selling their software to people who even don't have a strong need for the services you offered.

Customers avail subscriptions without understanding the services offered by the company. As a result, they left the services after using them because they didn't get the desired results. Therefore, it is important to attract the customers that need services offered by your company.

The best way for this is to discuss the services required by the customer and compare them with the services offered by your company. It helps to make sure that you are selling your product to the right customer, and he/she will continue with you in the long run.

Eliminating the wrong customers may make your customer's graph down, but it will benefit you in the long run. Also, it saves the resources you put into gaining the wrong customers.

SaaS companies need to be more accurate in their scope of work to reduce the churn rate. A low churn rate also reflects the integrity and loyalty of SaaS companies with customers that are good for the reputation of the company.

2. Bad customer support

As we know, SaaS companies deal with different types of online software. Usually, customers face various types of issues and bugs in the software. Customer always wants quick services and wants to resolve their issue on priority.

If a SaaS Company offers low customer support and needs hours to contact the company representative. It creates irritation for clients, and they like to leave the services.

A good way to deal with this issue is to hire a team of professionals and offer 24/7 customer support for your worthy customers. But keep in mind, that every team member must be an expert and capable of resolving the issue on a real-time basis.

It makes the client happy, and they like to create a relationship with the company on a long-term basis. Also, try to involve a bot response in case all the company representatives are busy with other customers.

It is clear from studies that SaaS companies with low customer support must face a high churn rate that indicates their death. Therefore, it is recommended to conduct a customer survey minimum of twice a year. It helps to improve the churn rate and is also useful to improve the performance of the customer support team.

3. Competitor's Approach

Even if you are a master of your industry, you can never ignore the presence of competitors in the market and especially in the SaaS industry. It is the priority of customers to gain services or products from a person that suits them more.

Therefore, it is much important to keep an eye on the activities of competitors and the features of their products. In case a customer feels that someone from your competitors offers more features, he/she will leave your services immediately.

Price is the most important factor that SaaS companies use to attract customers of competitors. You must have to compare the features of the competitor's products with yours.

4. Low-Quality Product

The quality of products is the most essential thing in the SaaS industry. Sometimes customers face problems again and again. They have to contact the customer support team more frequently.

Facing the same issue, again and again, can create irritation, and the customer likes to try the services of a competitor. It harms the churn rate, and when you calculate the churn rate, you find it higher on every calculation.

How Do You Measure And Calculate Churn Rate?

The calculation of churn varies from company to company based on the period for which the SaaS company wants to calculate churn. Some SaaS companies like to calculate churn monthly, while some like to calculate yearly.

Usually, churn calculation is straightforward, but many SaaS companies like to calculate churn in their way. There are about 43 ways of measuring and calculating of churn rate that SaaS companies use.

It makes it somehow complicated, but it will help a lot if you want to boost up the growth of the company on a long-term basis.

The basic formula to calculate churn is given below.

Churn Rate Formula

To this, the importance of the churn rate for a particular business is obvious. It becomes the base of almost every customer retention strategy. For a growing business, the number of new customers must be greater than churning customers.

When calculating the churn rate, there are various ways. The formulas used in this regard results in a percentage of customers lost or revenue lost.

The simple way to calculate the churn rate is to divide the number of customers left in a specific period by the number of customers a company started with for that period. The figure you got after applying this formula is the churn rate.

You can calculate this rate for a particular period as needed by you, i.e., annually, quarterly, or monthly. It depends upon the strategy of the companies.

• Churn Rate Formula Example

For more explanation, we will theorize a scenario and then will apply the pre-discussed formula. This way, any ambiguity left will be cleared. Let us start!

Suppose your company started its operation with 800 customers, and the company worked for a year. At the end of the year, your data showed 600 customers. Now you can apply the formula on these statistics as under.

Churn rate = (beginning No. of customers – ending No. of customers) / beginning No. of customers

Churn rate = (800 – 600) / 800 = 25%

It may seem quite simple and straightforward to calculate a churn rate. But it can be tricky since various factors can change the result. These factors can be a period, active customers, new customers entering, and so on. However, the above formula is a good starting point.

Monthly vs. Annual Churn Rates

You can calculate monthly and annual churn rates as per the requirement of your business.

On the other hand, companies dealing in products of a capital nature consider the annual rate. However, this is not a hard and fast rule. The real thing is the company's goals and objectives. To meet these goals and objectives, companies make strategies.

Hence, the strategy is at the core of whether you are supposed to consider a monthly or annual churn rate. Both rates are the same, but for different periods, i.e., the monthly churn rate is for a particular month. The annual churn rate is for a particular year.

The other difference originates from the fact that monthly churn is compounded over time. But the annual churn is calculated over the entire period.

Now we shall try to know the importance of these different churn rates through an example. Suppose a company wants to generate a particular amount of revenue in a year. Further, suppose that the company's fundamental component of the strategy is to monitor the churn rate.

First of all, the company will calculate the minimum feasible churn rate. Their goal is to maintain this churn rate throughout the year. Now the company will analyze the monthly churn rate and will make different customer retention strategies accordingly. It helps them to end the year with a declared annual churn rate.

Monthly and annual churn rates are not the only rates that are used by companies. Various companies depending upon their operations, industry, and requirement, can calculate this rate even on a weekly and quarterly basis.

Gross Churn / Customer Churn

There is a slight difference between Gross churn and Customer churn, but they are interrelated too. These are discussed below.

• Customer Churn Rate:

The growing businesses are more concerned about their customer churn rate. This rate is not considered a happy figure. However, it can help your company to know deeply about your customer retention strategies. You can find out the problems and rectify those.

Customer churn is the percentage of your customers that have stopped purchasing your products or service during a particular period. Companies always consider this rate because getting a new customer is always more challenging than retaining a customer.

To calculate the customer churn rate, first of all, you decide on a period. You need to calculate the number of customers at the beginning of that period (A) and the number of customers who left (B). Now divide figure B with A to have the customer churn rate.

• Gross Churn Rate:

The Gross churn rate is the money your business has lost due to customer loss. It means customer churn rate and gross churn rate are interrelated. How?

You can retain existing customers easier than making new customers as you have already built trust. If you retain 5% of customers, you can end up with an almost 25% increase in profit. These customers can spend more than 67% on your products because of the trust.

To calculate this rate, you first decide on a period. Then calculate the total revenue at the start of the period (A) and total churn revenue through period (B). Now divide B by A to calculate the Gross Churn.

In this perspective, you may have heard the name Gross MRR (Gross Monthly Recurring Rate). If we calculate the Gross churn rate for a month, it becomes the Gross MRR rate. Remember that Gross MRR is the frequently used terminology.

Net Churn / Revenue Churn

Net churn is also called the net MRR churn rate. To calculate this rate, you first need to take the difference between expansion MRR and churn MRR. Expansion MRR is the revenue generated from the upgrades in products or services or new customers.

The difference between churn MRR and expansion MRR is then divided by the beginning MRR of the month. Here is another quick example.

Suppose you have a beginning MRR of $50,000. You have three new customers because of upgraded products and services that resulted in $4,000 as an expansion MRR. Moreover, your company faced $6000 worth of downgrades or contract cancellations.

Net MRR churn rate = ($6,000 — $4,000) / $50,000 X 100 = 4%

By now, it would have cleared for you the difference between gross and net MRR churn rates. Simple speaking, the gross MRR churn rate is the overall lost revenue of previous customers. Whereas the net MRR churn rate additionally considers the demand for upgraded products.

Both net and gross MRR churn rates give you different information and are very important. Therefore, you should track expansion MRR and net MRR churn in addition to gross MRR churn.

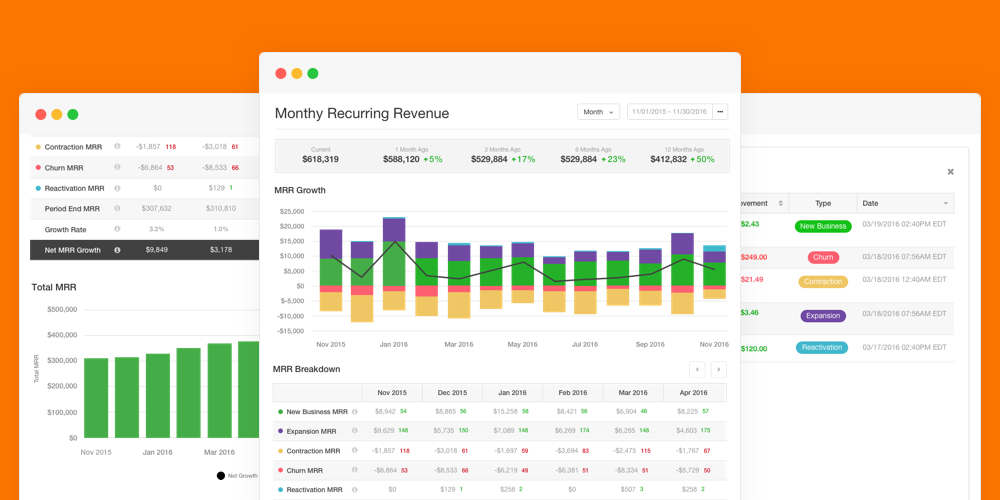

MRR Churn

MRR stands for Monthly Recurring Rate. The churn rate is calculated against MRR to get a percentage of the MRR churn rate. It is done because considering churn MRR into calculation gives an understanding of the impact of the churn on the business.

There are two main areas of importance of MRR Churn.

1. The product or service rending team is given a target to decrease MRR churn every month. Ideally, the product should have a 0% of this churn. It is impossible, so the teams are required to limit this figure close to 0%.

2. Higher management closely looks at the churn rate to predict future profit and loss. It can help in making, implementing, and analyzing the strategy.

How To Reduce Churn

With time different companies set an objective to reduce the churn rate. They use different strategies or sets of these to meet the purpose. The most frequent and significant strategies are discussed here.

1. Grouping Your Customers

As the first strategy, you should pool your customers and make various groups. The customers relating to the group that is most likely to cancel are the subject area. You can put more effort into this group to retain them.

However, there are different schools of thought. Some successful entrepreneurs are with the view of rendering services to profitable customers instead. According to them, putting effort into retaining a customer is not the solution but making more revenue is.

2. Be Proactive With Communication

It means to reach your customers' needs before these emerge. It is called a proactive approach to communication. Make them understand your products and service have more usability than their known ones. So, it needs new market strategies. Old outreach cannot get the results.

For instance, if you notice the customer is not leveraging your business, you can send them a friendly nudge. Send them emails and try to reach them with something that can value them.

3. Define A Roadmap Of Your Products Or Services

Always try to manage the customer's expectations. So orientate your products and services from the start. Let your customer know everything about your product or service systematically. It will help them to get interested.

Otherwise, if customers fail to figure out how to get into your product or service, they can quickly lose interest. Your first and continuous good impression will help you to retain the customer. It will help you to drop down your Chun rate.

4. Try To Give Customers More

You must give your customers a reason to stick with your products or services. The reason could be anything special to them, i.e., a discount, promo, incentive, or loyalty program. These small efforts can bring significant success to your products and services.

Moreover, you should offer these incentives in good times when they are needed. For instance, a contract with a customer will end, and you are not assured he/she will renew the contract. Consider this as the most proper time to come up with incentives.

Or another technique is to value the customer's needs. Your products and services should fulfill their needs at the right time. If your customers are getting what they want, they have no reason to leave your company.

5. Get Customers' Opinions

It is not possible that you are offering flawless products and services. Almost every famous brand has some areas for improvement. Therefore, always be in touch with your customers and try to know these areas.

If you know their problems, do not solve them only. You should know the real cause of that problem. If you have understood that cause and rectified it forever, you will not have to face any other unhappy customers.

Therefore, customer feedback is essential. The technique to get the customer's opinion depends upon your business. Some businesses can do it through email; some need traditional surveying and face-to-face interviewing with customers.

6. Analyze Churn When It Happens

Do not wait for your customer to leave you. Instead, be proactive and try to collect data periodically that can help you in making active strategies. However, the churn rate can be minimized, but it remains part of any business.

You can use your churned customers. You can know the primary key elements that encounter a churn rate. So always perform some analysis.

You can start to analyze when specific customers churn and at what specific times. You can make different periods of customers' commitment to your brand. These analyses can help you to configure when, why, and which customers will leave you.

You can focus on these customers to get feedback. Try to know the fundamental reason for churning. Solve their problems as soon as possible to avoid a future loss to your business.

7. Stay Competitive.

Today, things are changing considerably with time. You cannot run a business successfully with the techniques used a few years before. The businesses capable of seeing the future are the leaders and resultantly write success stories.

Therefore, to be competitive, you must forecast the future according to the industry you are working in. At the same time, your products and services must furnish the current needs of the customers.

The most excellent way to address this issue is to compare your company with the industry. It means to try to know your strengths and weaknesses and use these to utilize the opportunities and defend against threats in the external environment.

Another simple way is to continuously examine your potential competitor's prevalence in the market. The reason is you and your competitors make the industry, and you both are the driving factors of your customer's needs.

Comparing B2B vs B2C Churn

The difference between the churn rate of B2B and B2C is because of the difference between the markets where companies operate. Let us discuss it.

• B2B Retention:

It is not only one individual when B2B companies lose a customer. They lose the whole team of users. If this team is unhappy or faces trouble using your products or services, they won't recommend you. It can be fatal.

Contrary to this, if you retain B2B customers, you do not retain only one individual but an entire team of individuals. Their recommendation can grow your business exponentially.

• B2C Retention:

Generally, a B2C market is much larger than a B2B market. Therefore, companies doing business in B2C can feel they have a large market to move on when customers churn. But remember, this market has more unpredictable customers.

In B2B, the individuals of one company are bound to purchase products from another specific company. B2B requires them to get into a contract. In contrast, in B2C, customers are autonomous in choosing and leaving your company.

It means B2C can result in more churn rate of customers than B2B. However, they have a greater opportunity to attract more customers from the market to balance it out because new customers can balance churning customers in revenue generation.

Customer Churn Analysis

Customer Churn is the most challenging and critical problem for every business. These businesses include not only SASS but also credit card companies, telecommunication companies, and cable service providers.

Preparing and analyzing churn metrics can help companies a lot to improve their customer retention strategies. To do this effectively, we can group churn rates into different categories.

• Contractual Churn: When the customer can decide not to go with a particular company after the contract expires, i.e., in SAAS services and cable companies, It is called the Contractual Churn rate.

• Non-Contractual Churn: When a customer can leave a purchase without completing the transaction or any transaction could be the last one. It is said to be the Non-Contractual Churn.

• Voluntary Churn: When a customer can cancel the existing service, i.e., from streaming subscription and prepaid cellphones, It is a voluntary churn.

• Involuntary Churn: When a customer does not intentionally, or himself leaves your company, it is called involuntary churn. For example, a customer cannot pay through a credit card and is no longer a customer of a Credit Card Company.

- For voluntary churn: Simplify onboarding / Improve product quality / Add new features / Improve customer support

- For involuntary churn: Implement a dunning strategy / Use an account updater

The grouping helps companies to make various strategies to retain customers. Or they can precisely predict the type of customers and their churn. The fundamental way to avoid churn is to understand your customers to know them through previous and new data.

Churn Rate Benchmarks

According to Bessemer Venture Partners (BVP), an annual 5-7% SaaS churn rate is acceptable. Pacific Crest also backs BVP's assertion in its Private Saas Company Survey Results.

As per the pacific Crest survey, 70% of Saas companies showed an annual churn of less than 10%, and a further 75% of those showed less than 5%.

It is not the lower number of customers at your front door that limit the growth of your business. It is the churn rate when getting high that your business faces severe results. Therefore, churn rate benchmarks are observed by various companies.