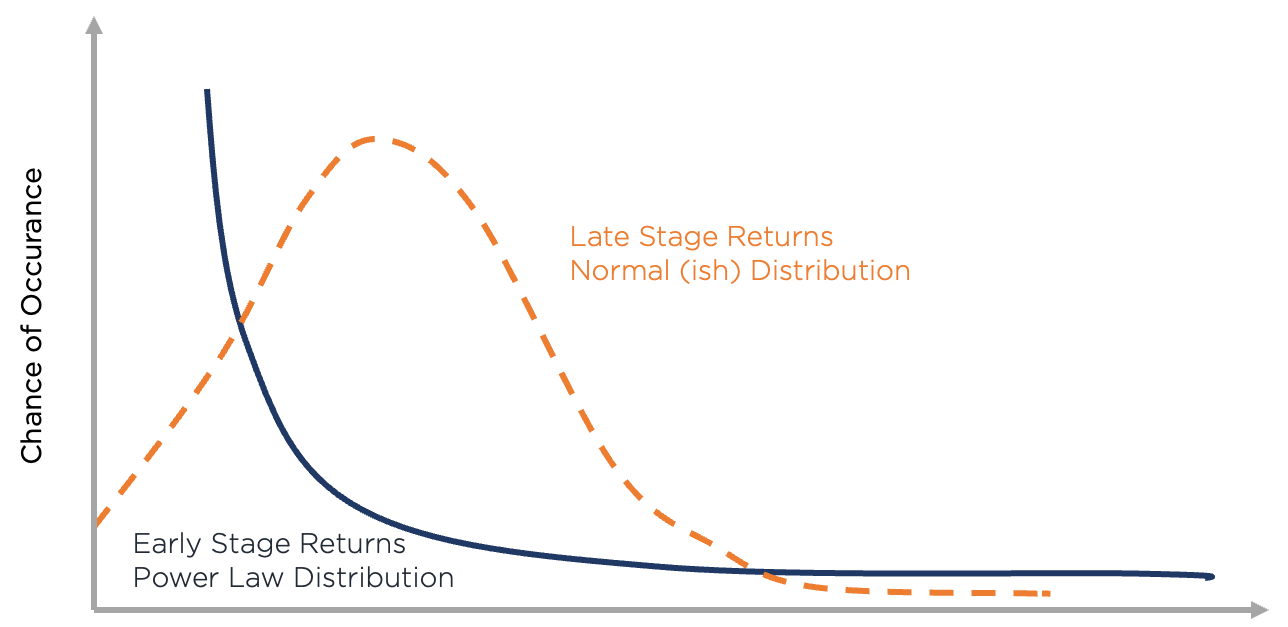

Power Law vs Bell Curve in Investing

In the world of investment, knowing your distribution is hyper-critical. It sounds mathematical, but understanding the dynamics of "Power Law" vs "Bell Curve" is important for investors navigating between the public and private capital markets.

Investing in public assets: Bell Curve dominance 🔔

In public markets, investment returns often follow a Gaussian curve distribution. This means that most returns cluster around the mean, with fewer outliers at both extremes. This pattern is driven by market efficiency, regulatory frameworks, and a large number of participants, which results in a distribution in which extreme successes or failures are less common.

Investing in the Private Market: Power Law Arena 💪

Conversely, private markets typically exhibit a power law distribution. This phenomenon is where a small number of investments earn disproportionately high returns, dwarfing the majority of investments that earn low or even negative returns. Key factors contributing to this include:

- Availability of liquidation preference: this refers to the order in which investors receive payouts in the event of liquidity, where first investors receive their capital back before management and founders do, due to the fact a professional fund manager

- Lack of liquidity. Private markets are highly illiquid, meaning investments are often held for longer periods and exit opportunities are fewer and farther apart.

- Risk-return profile. Most public companies are much less risky in nature, due to the fact that in order to be listed on the stock exchange, you need to have hundreds of millions of dollars in revenue (sometimes, of course, there are less mature businesses), which greatly increases the predictability of their results and reduces the risk of bankruptcy. Private investments, especially in earlier-stage companies, are inherently much riskier, but the potential for huge returns is significant for those who do well.

Implications for risk, return, and volatility of results

The different distributions in the public and private markets create unique risk profiles. In the public market, risks are more predictable and moderate, while in private markets the risks are higher, with a greater likelihood of both significant gains (🦄) and losses.

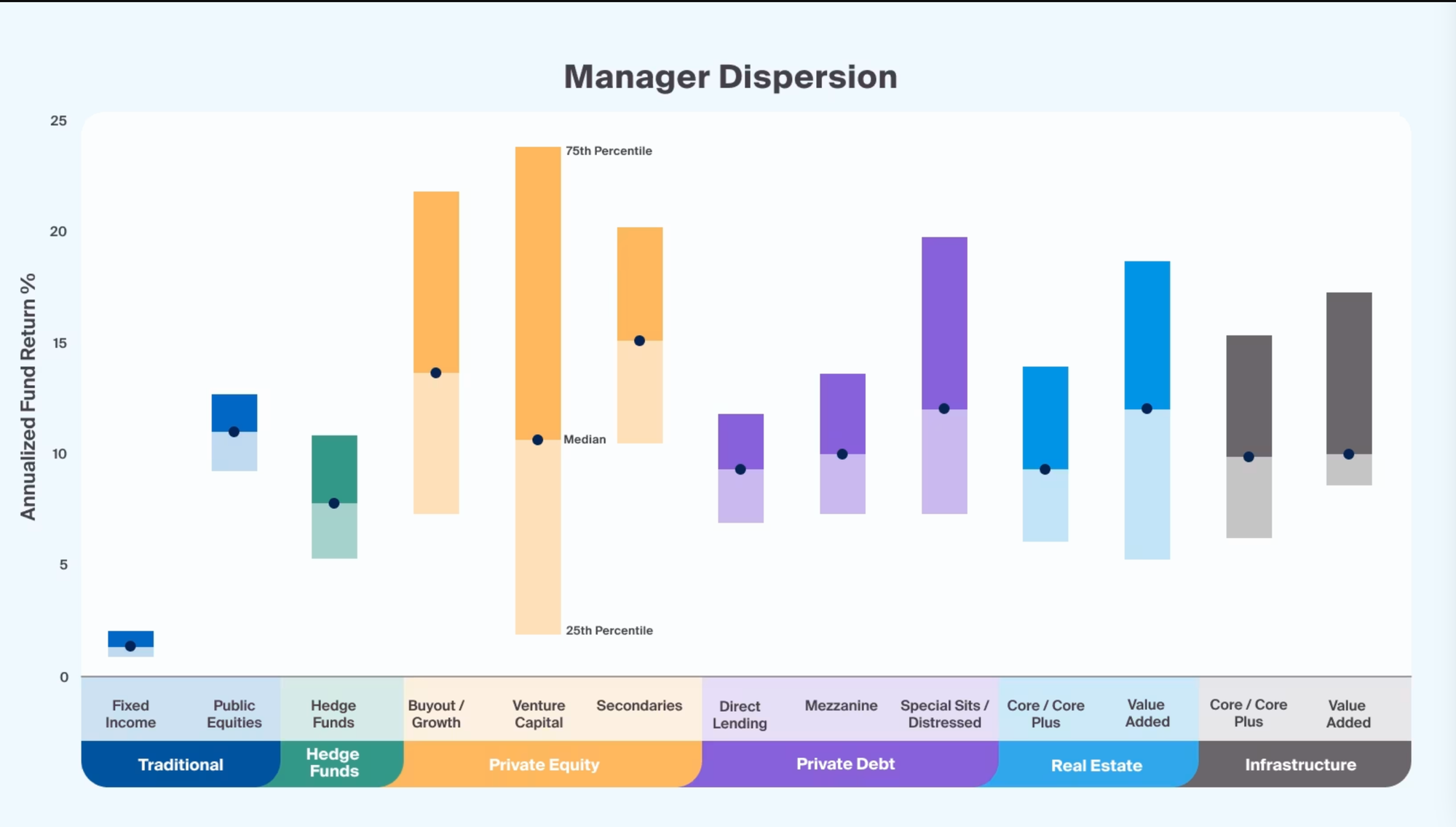

Understanding these different dynamics is critical for investors. While the Bell Curve provides a more stable and predictable investment landscape (which in turn makes the variance in fund manager performance much smaller), the Power Law opens up opportunities for significant growth, albeit at higher risk (which makes the variance in fund manager performance much smaller) but with several times higher volatility.

Investors should align their strategies with their risk tolerance and investment objectives, recognizing that the drivers behind these allocations are fundamental to the nature of each market.