Snapchat IPO valuation: is it worth US$20bn?

Snapchat's IPO has been on the news block for some time. It is indeed one phenomenon of needs of Millenial's generation. Getting from 0 to 150m DAU in under 5 years is indeed very swiftly. Yet as even as public markets are at its all-time peak, let's look at fundamentals.

Below is my take on valuation. Key historical users metrics and financials with comparison among facebook, twitter and snapchat can be downloaded below.

Download excel: Snapchat IPO valuation

INVESTMENT HIGHLIGHTS:

-

Strong product founders combined with management team with experienced from advertising to content and global leadership

-

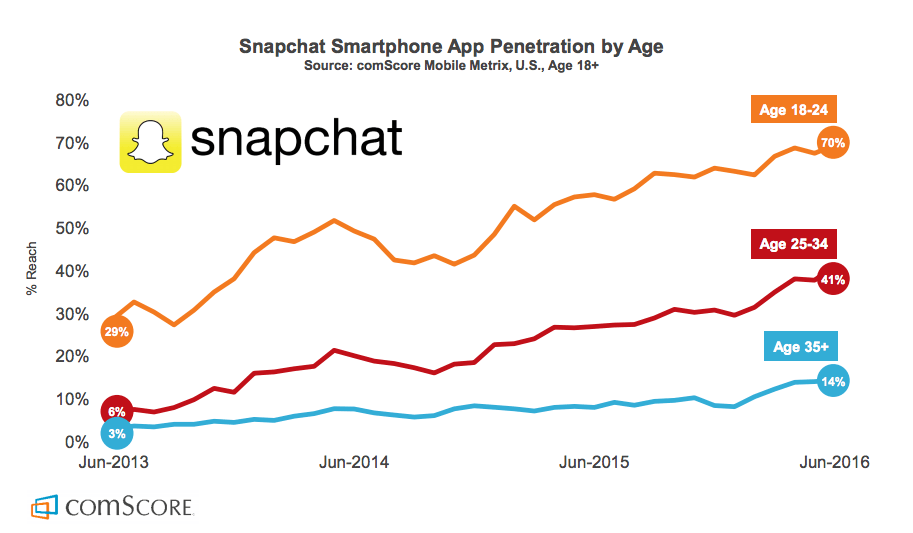

Overall reach with 150m DAU and astonishing penetration among the Millenials (with over 70% reach) and Generation Z (over 40%) in the USA

-

Younger audience ( <30 y.o.) engaged per day half the time of facebook and average user does 18 snaps per day.

-

Quick pace of APRU per DAU from USD1.2 in 2015 to USD5.5 in 2016 in US market.

RISK AND CONCERNS:

-

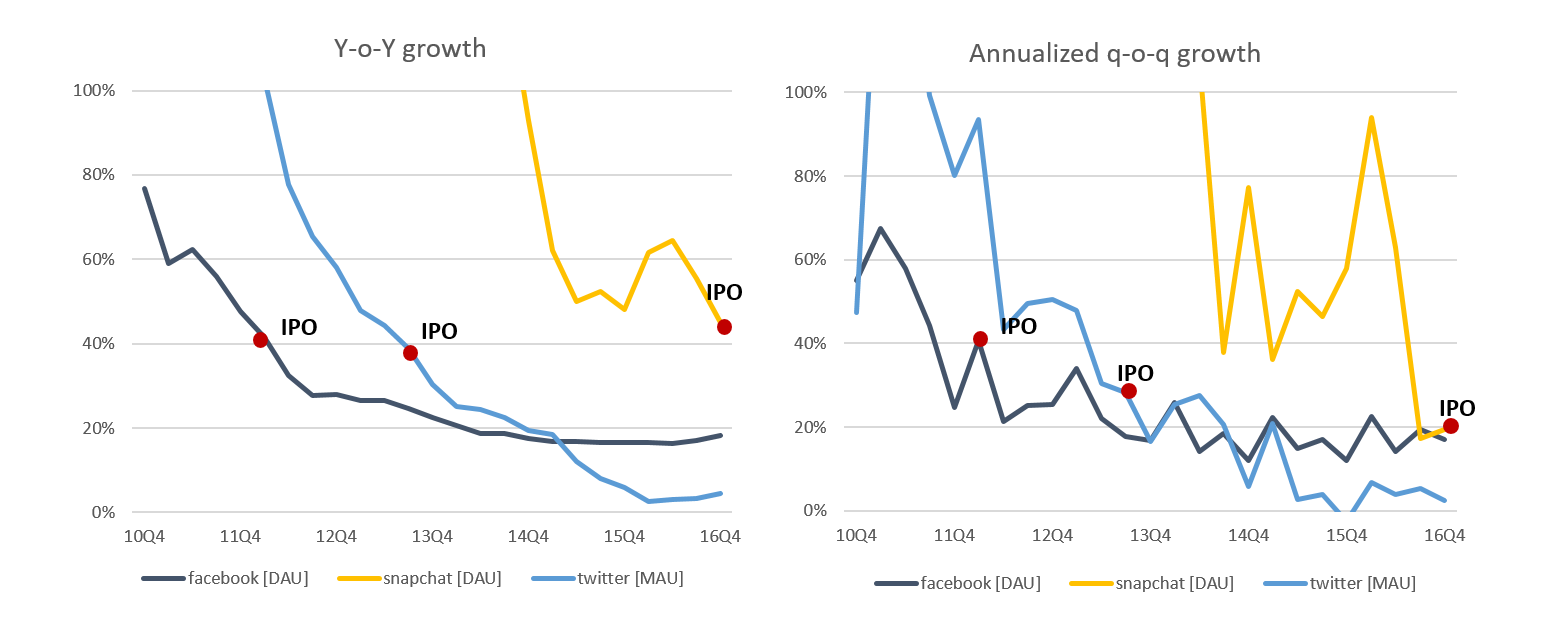

DAU growth has slowed in last 2 quarters to below 20% q-o-q on annualized basis vs over 50% in the preceding quarters

-

European monetization per DAU lacks pace of USA market

-

Company only in 16Q3 got to positive gross profit margin with already huge cloud infrastructure commitments to Google and Amazon with my forecast to reach EBITDA profitability only by 19Q4.

-

Significant competition threat, especially from Facebook in the West and Snow in the East

-

IPO shares will not have voting rights (which might not be such a bad thing for a product company if you trust in founders, Yahoo case clearly tells a story how boards can continuous destroy value)

Let's break it down:

1. REVENUE GROWTH:

- Audience growth:

At the end of 2016, Snapchat had 161m DAU: 38% from the USA, 51% from Europe and 50% from ROW (Rest of World). When looking at the Snapchat's DAU growth (40%+) it is similar to that of facebook at the time of IPO in 2012Q2 (41%).

However, when looking at quarter over quarter growth, we see an abrupt drop in last 2 quarters from 60-90% in 1H2016 to under 20% in 2H2016. Current quarter over quarter growth is actually very similar to facebook (facebook though has ca. 8x in DAU). At the time of facebook's IPO annualized q-o-q growth and y/y was fairly consistent in 25-40% range.

The chart below shows how Snapchat's usage differs by age groups. The young population is already quite saturated with reach over 70%, older population despite growing is by far of a similar reach. Based on growth of smartphone ownership and Snapchat usage I assume in 5 years NA audience would reach around DAU ca. 110m (more detailed in excel)

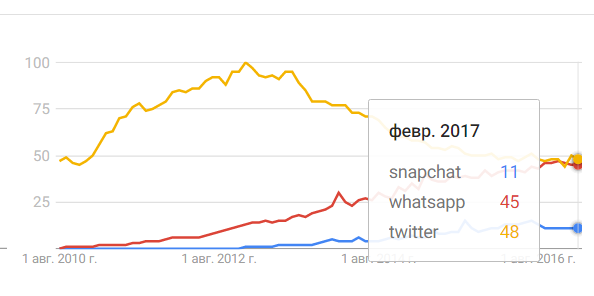

Also, google trends query of Snapchat show the search volumes are not growing last year. It doesn't tell us exactly that growth is zero but creates grounds to forecast even in optimistic scenario to maintain annualized growth at ca. 20% q-o-q going forward.

Reference: twitter search volumes decreased by half correlate with decline in q-o-q annualized growth from 40% in 2H2013 to negative by 2015Q3, in 2016 growth has stabilized.

Overall, in the next 7-8 years I expect Snapchat to reach ca. 0.5bn DAU with 25% from USA and Canada, 35% from Europe and 40% from ROW.

Reference: facebook (5 years after IPO) has 15% from USA and Canada, 21% from Europe and 64% from ROW).

- Monetization of audience:

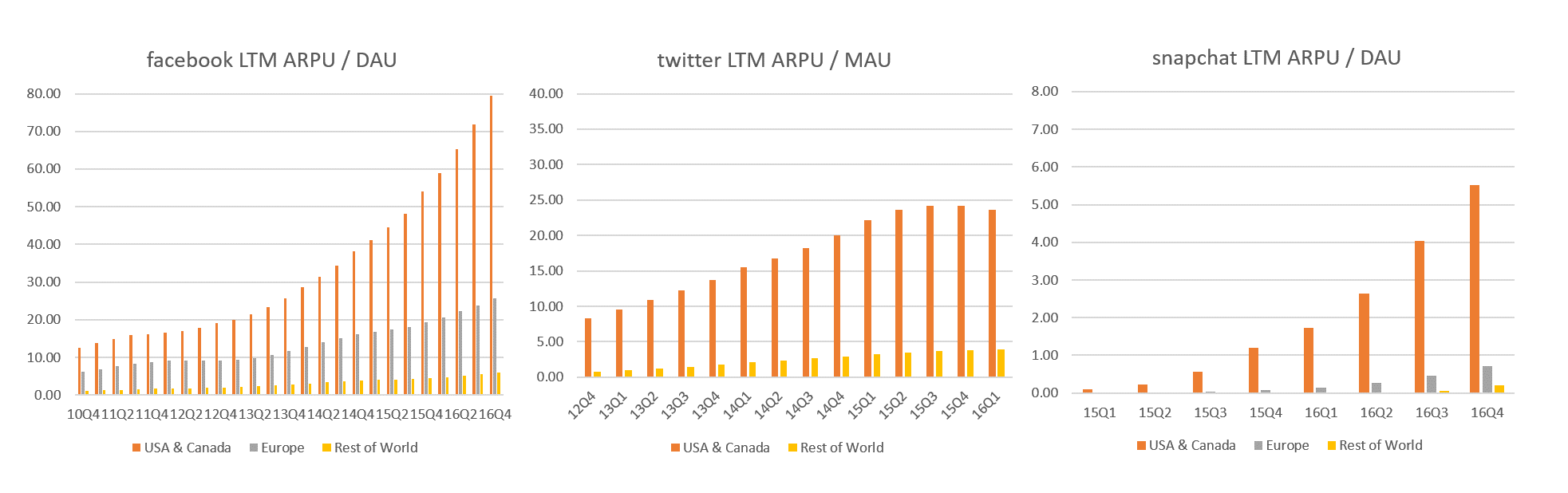

To forecast revenue, let's look how well each geography monetizes.

Facebook since early days had an internationally monetizable audience, Europe was around of half of USA sales and ROW users generated around 10% of USA users. Twitter's international was about the same, ca. 10% of North America's per user.

Snapchat despite having very strong European user base monetizes it very poorly (<15% that of USA revenue per user). Rest of world users also generated less than 5% of that of USA & Canada.

For Snapchat improving monetization across all regions will be one of the key challenges. First signs do exist: European revenue per users grew from 5.5% of USA to 12.8% in last 5 quarters, but it is still far below compared to facebook.

Below is last twelve month (LTV) of quarterly revenue per User: DAU for in case of facebook and Snapchat, MAU in a case of twitter.

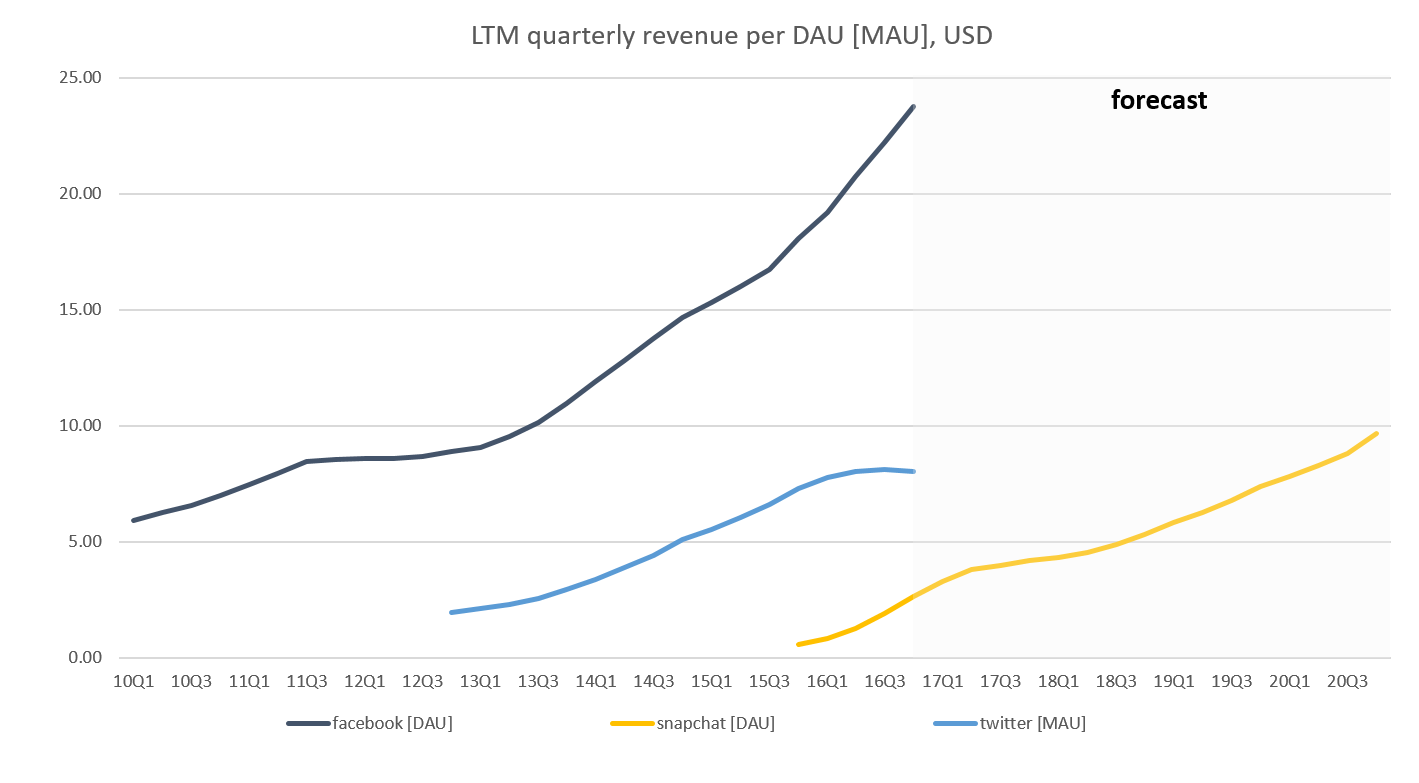

I forecasted Snapchat revenue ARPU per geo-based on previous growth dynamics that of facebook. Blended APRU per DAU [MAU] is shown below:

Forecast of APRU growth beyond 2020 was done conservatively, at 10% per annum. Twitter's dynamic demonstrates explicitly that scaling user monetization with only one format of communication is hard. Facebook, on the other hand, has many channels (from in-game purchases to desktop ads to mobile installs)

-

Revenue and market share:

Digital mobile video ads market is estimated at US$4.4bn in 2016 and positioned to grow ca. 4x till 2020 to US$17.4bn just in USA. Based on above assumption Snapchat revenue in NA is forecasted at US$2.5bn or only 15% of mobile video ads market (for example, facebook today is 12% of overall digital ads market)

2. EBIT MARGINS:

- COST OF REVENUE:

One key cost of any internet company is its cost of its infrastructure.

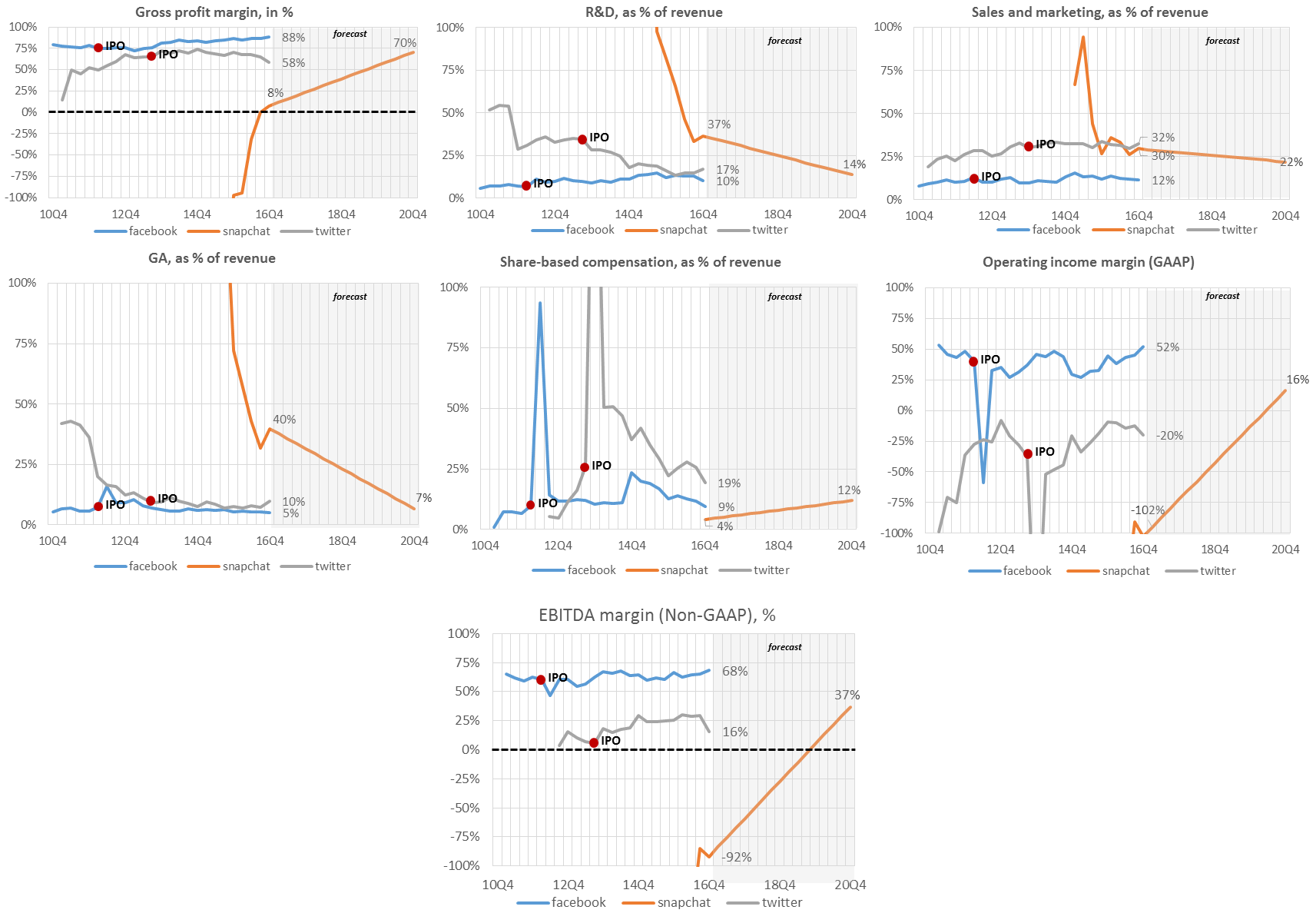

Up until consumption of videos became popular, running costs were relatively low (facebook always maintained its cogs < 25% since very early days). Twitter's infrastructure was always a bit more expensive, mainly due to the requirement to processes in real time high load of updates.

Snapchat, on the other hand, is heavily driven by video traffic, which is expensive to scale-up with low user ARPU, especially when a significant part of the user base is not monetized at all. The cost of sales became less than revenue only in 16Q3 with gross profit reaching 8% in last quarter.

One of the most optimistic assumptions going forward is snapchat's ability to reach gross margin by 2020 that of an average of twitter and facebook.

-

R&D: costs of engineers are relatively limited, In steady state, it is safe to assume they would reach 14% of revenue. Both twitter and facebook maintained them in 10-17% range (excluding stock compensation)

-

G&A: same as R&D, G&A is traditionally capped at 5-10% of revenues in the mature state (excluding stock-based compensation), my estimate snapchat's metric is going to come down from current 40% to 7% (excluding stock-based compensation).

-

S&M: Marketing costs are not something Snapchat can neglect going forward, growth is slowing down, and much of younger audience is already being saturated where most viral marketing works.

Sales in the case of Snapchat it is being done primarily via direct sales and still not really self-serve which means high running costs.

Currently, the majority of ad revenue comes from "fat wallets ad spenders" where ad margins are traditionally lower. My optimistic assumption it will come down to an average of twitter and facebook.

The increase in S&M in 2016 was 357%. This was primarily due to an increase in sales and marketing headcount of approximately 340%.

Source: Snap Inc. S-1 filing, page 74

-

SHARE-BASED COMPENSATION: GAAP allows to reduce taxable income for share-based compensation. Twitter's and facebook's metrics shows after IPO the figures come down to 10-20% range as % of revenue.

-

EBITDA BREAK-EVEN: Despite Twitter was always a loss-making company according to GAAP, at the same time it started to generate positive EBITDA almost a year before its IPO. My estimate EBITDA break-even point would be reached by snapchat only in about 3 years.

3. REINVESTMENT

Key investments in IT companies are in own infrastructure to reduce OpEx, however, Snapchat signed 2 major deals with Amazon and Google Cloud to spend over 500m per annum on them. My take is that sales / CAPEX will be higher than facebooks and twitter at around 2.7x.

4. RISK AND COST OF CAPITAL

Despite markets at all time high with, my estimate of the long-term cost of capital as 2.3% (risk-free rate or US 10Y-treasuries) + 0.85 (beta) * 4.5% (ERP from 1926 to 2003) which results in 6.3%. The initial cost of capital was chosen at 10.00% based on Damodaran calculations for companies in advertising space.

5. CASH AND DEBT

Currently, snapchat has almost US$1bn in cash with a present value of debt ca. US$310m due to operating leases or Net Debt at -US$0.7bn.

6. VALUE PER SHARE

Based on inputs above, Terminal Cash Flow equates to US$1.2bn in 2027 or value of operating assets today at US$16bn (if you believe in long-term ERP of 4.5%, as it is quite sensitive to it).

Subtracting negative net debt of US$0.7bn while adding ca. US$3bn from IPO proceeds we get ca. US$19.7bn in equity value or US$19bn in equity of common stock (currently there are ca. US$700m outstanding and vested options) or US$15.25 per share.

So, the stock is priced in?

The answer to that question would be "yes" if you believe in

optimisticaggressive assumptions highlighted above as well in management ability to execute on them.

What are the possible growth drivers to re-iterate a more positive outlook?

-

Spike in snapchat adoption of elder population (35+)

-

European APRU / DAU shortens the spread with that of North America users

-

Long-term deals with Amazon and Google would allow for gross margin to reach 50-70% range much quicker

How does Snapchat's IPO compares to the previous of facebook and twitter?

-

Facebook's IPO priced at US$100bn market cap was heavily criticized as overly expensive placement and its stock has indeed tanked quickly by more than 50% from IPO's price of US$38 per share to US$18 per share. Yet, over last 5 years, as the user growth picked its pace the value of the company has rewarded the patient shareholders and the stock more than tripled from IPO's price.

-

Twitter's IPO, on the other hand, was considered a huge success at the time, surging from IPO price of US$26 per share to almost US$42 on the first trading day and reaching within first 2 months almost US$70. Midterm picture though isn't as glamorous, trading for more than a year now with 30% discount to IPO price.

-

My opinion is that current case of snapchat resembles a case of twitter: currently, a company has mediocre financial results (worse than twitter's at its IPO), yet with stock markets at its peak there is a medium possibility of short rally initially. Long-term picture heavily depends on whether a company can maintain user growing base above 15% on annualized basis with constantly increasing APRU per DAU across all regions as well reasonably quickly get to positive EBITDA state.

Snapchat IPO valuation excel model can be downloaded here

======================================================

Further insightful read on snapchat figures: