If VC would've been a sport - it would've been Baseball

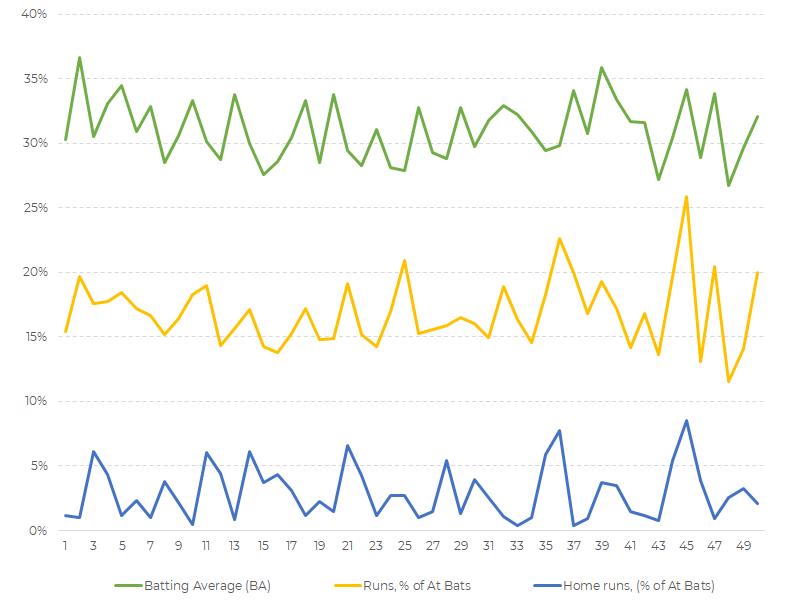

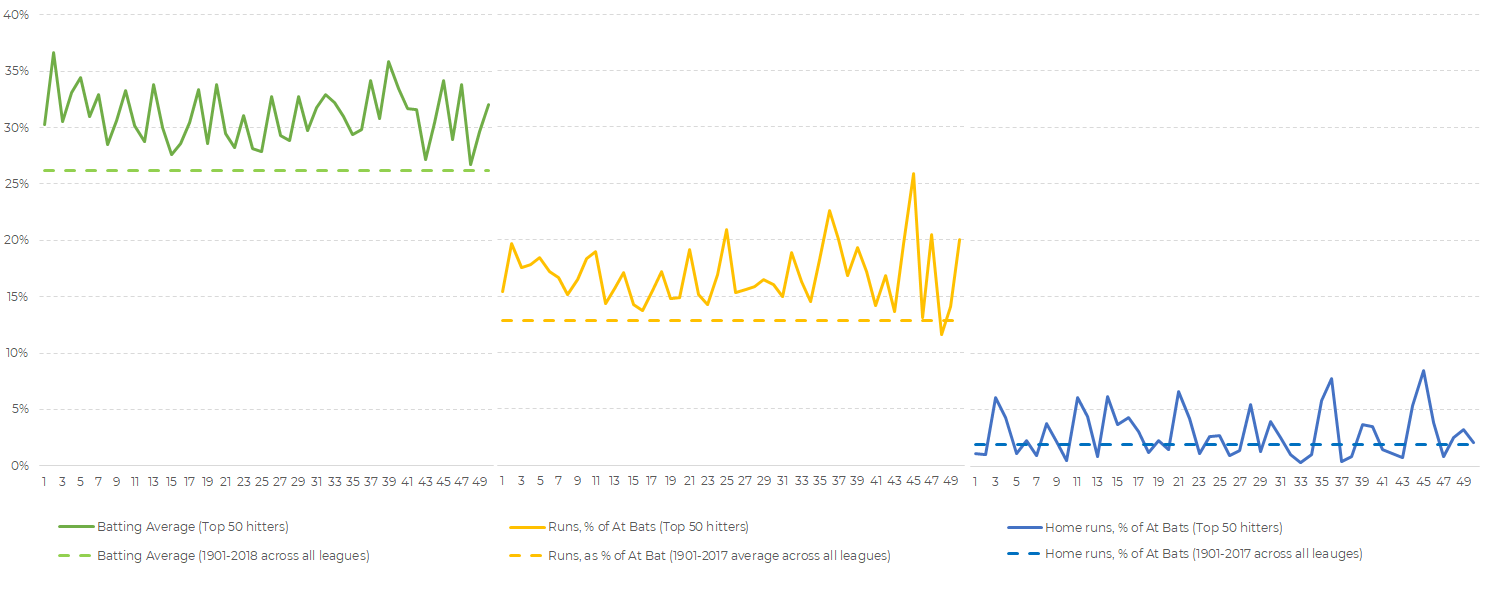

It's a pretty popular fact that greatest baseball players hit the ball every 1/3. The green line below show this as fairly consistent across the top-50 hitters historically (the 50th having 2839 hits, so it's quite reprentfull).

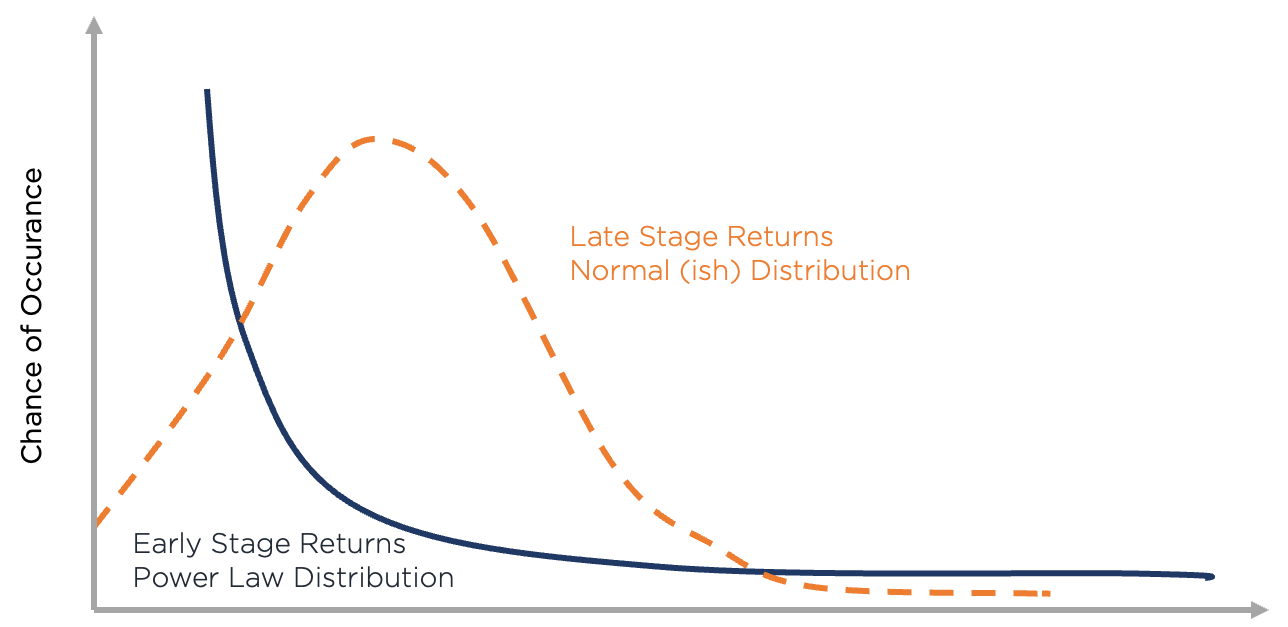

While the greatest hitters do an average 15-20% a better job than the overall baseball industry, not all hits are created equal: between 15-20% of hits actually produce a score. And moreover around 1-3% of At Bats hits are actually product a home run.

Not to say that VC is a sport (to some extent within the industry it is) but if I would to stick a sport analogy for early-stage investing - it would definitely be baseball.

So, why early-stage VC is a baseball?

The definition of an early-stage VC is quite wide, ranging from (i) pre-seed, when there is nothing but an idea to (ii) seed, where the idea has a solution but without any proper monetization or distribution to (iii) Series A, when either monetization or distribution is on some track.

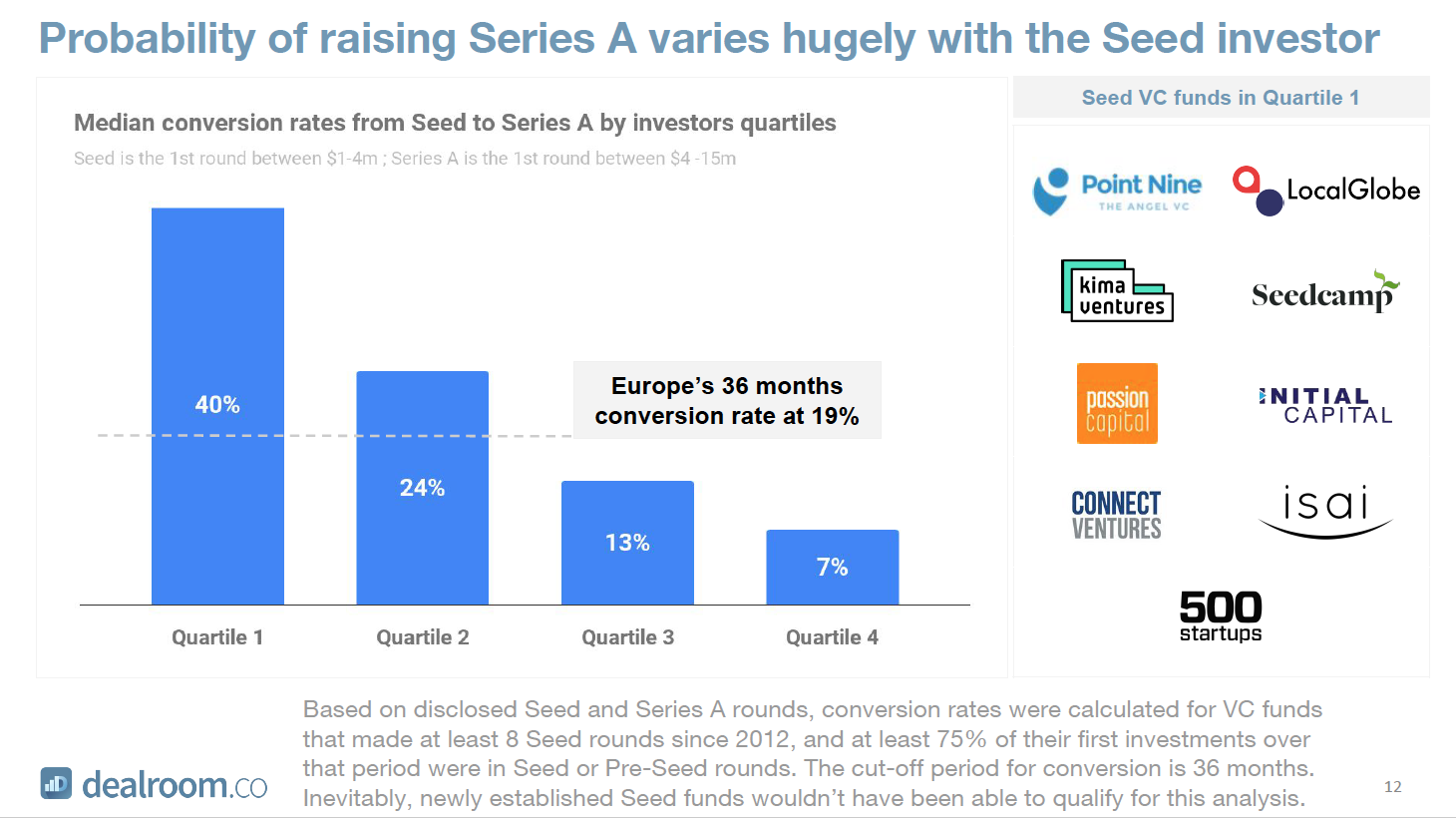

Statistically speaking its varies across the quality of a seed investor due to more solid founders behind the wheel, but on average its in the ballpark of 20-30%, very similar to what is hit ratio in baseball. Hitting a ball doesn't necessarily mean a run score, only 50% actually produce a score and only 1/4 or 1/5 of scored runs were home-runs. Similarly in VC, raising Series A is just a first milestone on the way to liquidity down the road.

I would consider a VC to have scored a run if the early stage fund returned more than it invested. Most M&A happened after Series A investment, meaning post-money valuation is likely to be in the ballpark of $30-50m (for seed M&A the post-money threshold is probably closer to $15-20m)

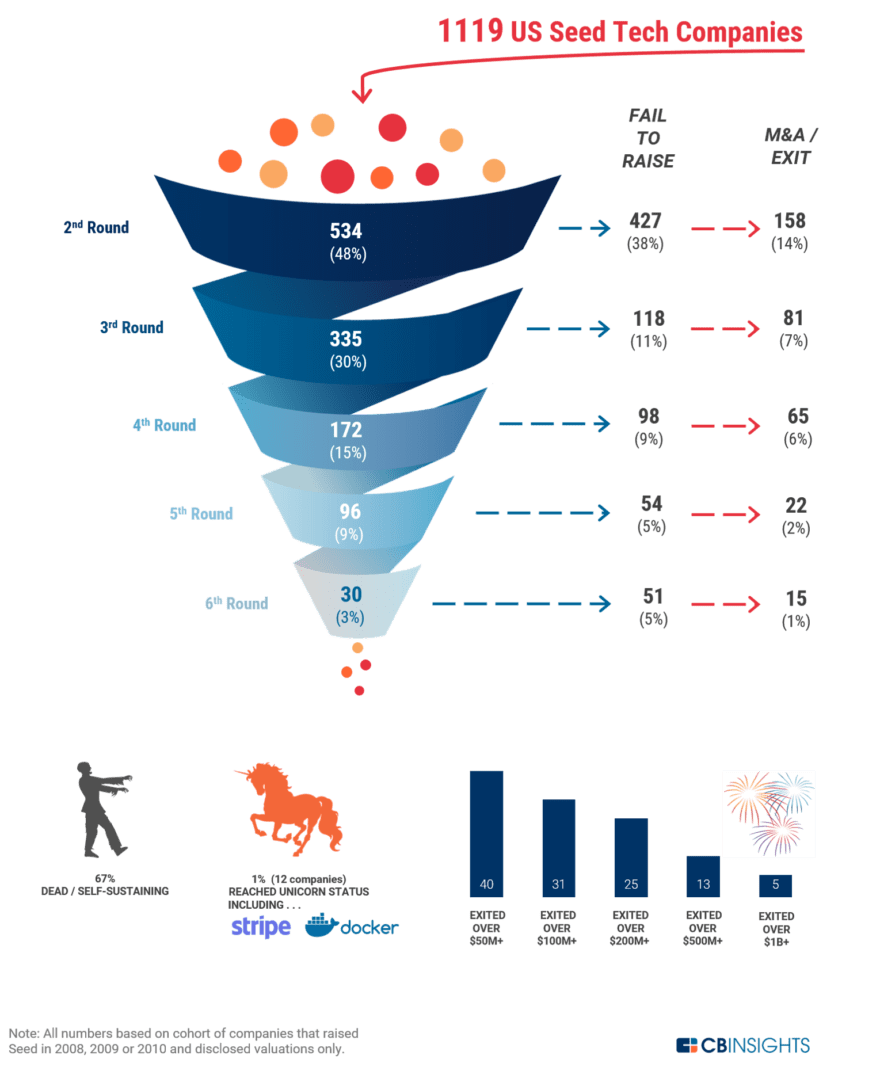

On the broader US VC funnel (based on 2008-10 investment cohorts) M&A events happened on about 30% of seed funded companies, however, exits with over $50m in value represent only 114 out of 1119 or 10% of US seed deals, again quite similar to 13% of scored runs as % of At Bats in baseball.

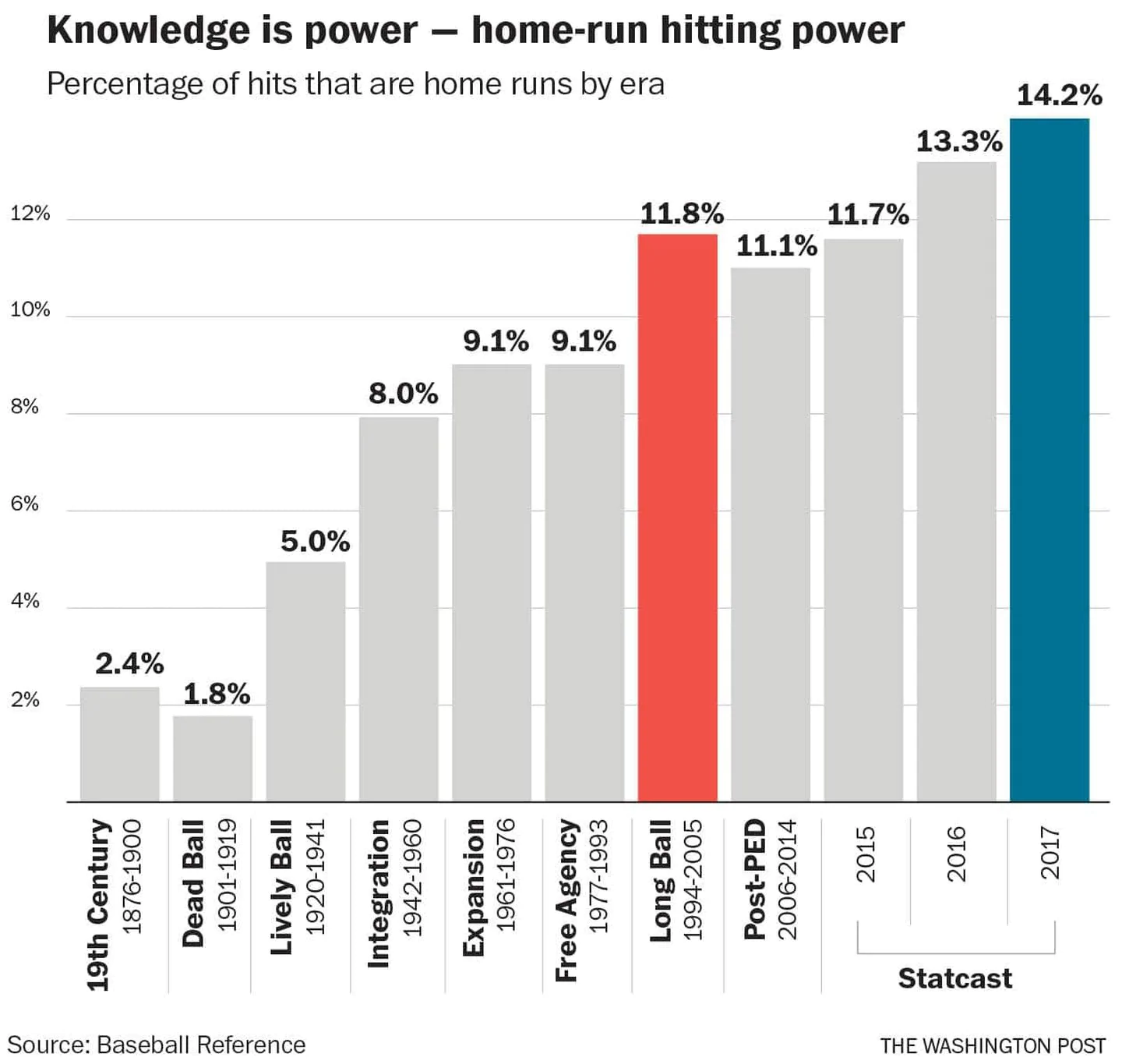

Hitting a Unicorn in VC is like a home run in baseball with key difference of not needing to wait about 10 years to find out. In VC world, the data states its happens in about 1% of overall seed deals. In baseball home runs as % of At Bats were around 2%, significantly climbing from under 0.5% in 1900-1925 to over 3% in 2000-2017.

To conclude:

- Average tenure in baseball among top hitters is over 20 years, which is quite similar for partner level at most seasoned VC firms.

- Hit rate of baseball players is round 25-30%, which is what Tier 1-2 firms achieve while going from Seed to Series A

- Average scored runs in baseball account for around 13%, whereas % of seed funded companies get acquired for over $50m is around 10% (probably will rise slighlty over the next 5 years, as there are still a couple hundred companies in live mode)

- Chances of hitting a homerun are low single digits, though rose significantly in baseball due to accumulated knowledge over time.

Unlike VC which has mainstreamed only abound 20-30 years ago with the rise of the internet and software, baseball as a game has been here for over 120 years (roots in USA go back to mid-19th century and for cricket in general it's another 2 centuries) and has seen over 3-5x improvement in the performance of hit ratios over the last century. Wonder of how much improvement we'll see from the early-stage VC during the 21 century.

Cheers,

Tony

PS: If you are an early-stage founder with approaching or over US$1m ARR and looking for funding - please ping me at anton@flashpointvc.com