Thoughts on VC's DNA

Yesterday, there was a good post from Steve on Hackermoon on what are good traits of a VC.

Here are my few lines on the topic.

Beyond qualities of being an insightful and knowledgeable folks whom its good to work with, here is a short of list of qualities which are important for both LPs who invest in VCs and entrepreneurs who take their money.

-

Accountability: Holding yourself to the same expectations and standards as you hold your portfolio companies. Especially in very early stage, business don't build themselves, everyone must pitch-in and be at least proactive in its own way.

-

Trustworthiness: VC is a closed community with globally employing ~15-20k people at ~2k funds, with many LPs rolling their capital from one fund to the next one. Being trustworthy and acting in such a way with transparency is one of the most important skills in institutional asset management.

-

Inquiring: It is one thing to be curious, getting to actionable insight is key.

-

Therapeutic: Being a CEO's is a lonely job (Mark today done a nice job telling why is so, re-energizing with confidence to get back help can be better than serotonin. Also, being a good mediator is of great help when resolving founder/shareholder conflicts.

-

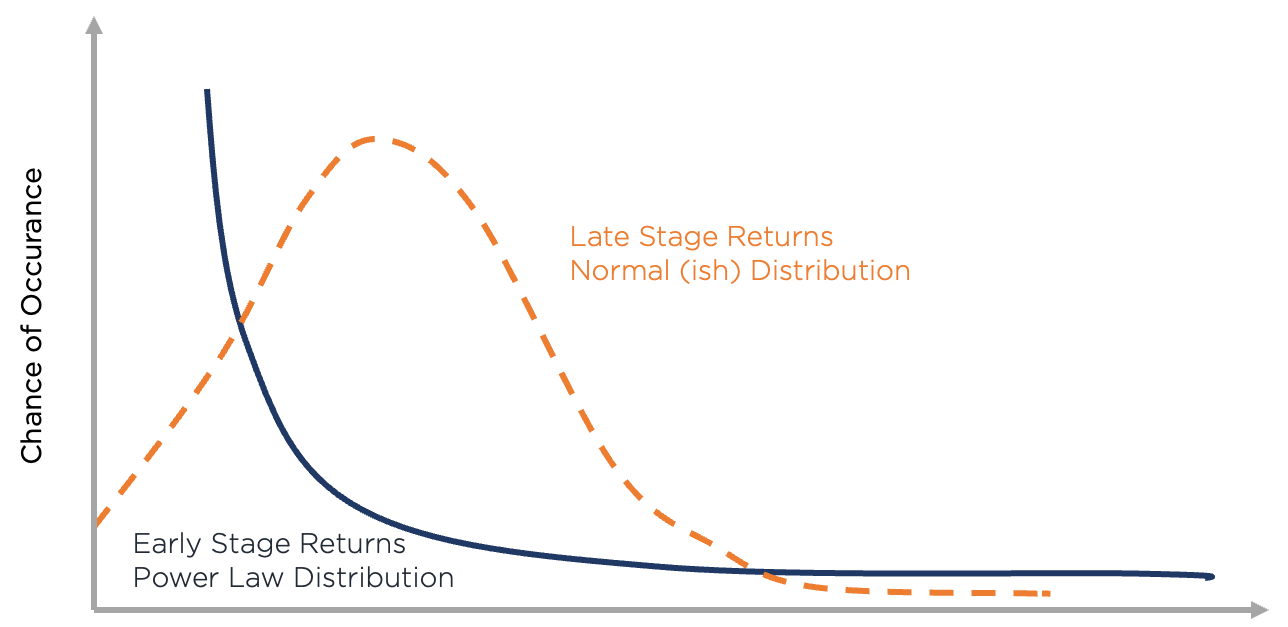

Believers/Risk-takers: naming yourself a visionary is kind of arrogant, yet having a leap of faith in people and taking risk (of course, supported by data) is what this job is about.

Seeing there are only couple dozen thousand people, most VCs by selection bias are good professionals with expertize, network, being good sales and strong focus.

My personal belief is that a successful VC firm can named one after it being able to raise at least 3rd or 4th fund and just as the DNA string can replicate itself, so can the VC if the mentality of the team is in place.

We are only in the beginning and just closed our 2nd fund, for us there is much more yet to prove.