Inside the unicorn startup

Last 5 years has been a boom not just in equity markets with S&P500 from 1300 to 2150, venture capital has truly brought to the world an animal named the "Unicorn", a swiftly growing company with >US$1bn valuation.

Almost every founder has a wishful thinking of becoming a Unicorn, yet many of these staggering valuations come with a cost imposed by VC:

- Liquidation preference and

- Preferred dividends

There many many other less material provisions, but these ones affect the distributions the most at the liquidity event date.

Here is a snapshot of protective provision imposed by the VCs on unicorns:

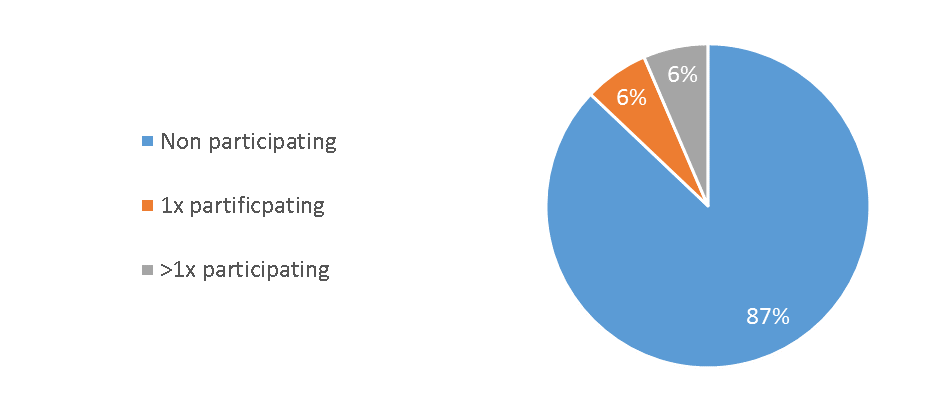

Liquidation preference:

VC investments contain great asymmetry of information. To offset this risk VC introduce Liquidation preference to at least return their investment.

Despite that asymetry, most of the unicorns were able to fundraise at high valuation without stressing out future distributions with almost 90% with only non-participation liquidation preference.

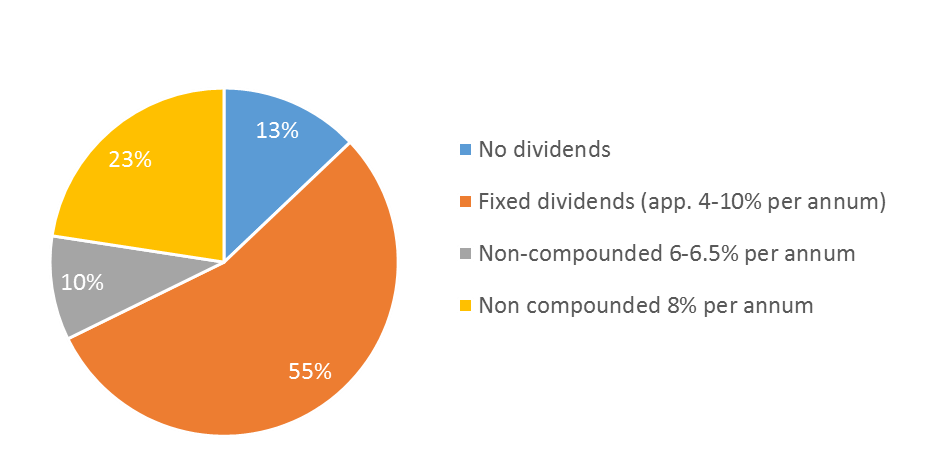

Preferred dividends:

Preferred dividends, on the other hand, were employed at almost in 90% of unicorns. VC investors have own hurdle rates typically in range of 6 to 8% per annum before which they can not earn carry, so many of them relocate beating such threshold to portfolio companies.

Here you can find the broader picture on how VC provisions evolved in Silicon Vally over the last couple of years.

Source of unicorn data: PitchBook

If you raising a round, the above stats should give an indication of what's the median.

A.